Cash Flow Hedge Vs Fair Value Hedge

A cash flow hedge is a hedge of the exposure to variability in cash flows attributable to a particular. This is your one stop shop.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

While both are used to hedge against changes in the value of the asset the cash flow hedge is more often tied to changes in one or more types of interest rates.

. A CASH FLOW HEDGE is something that HEDGES against changes in CASH FLOW. A FAIR VALUE HEDGE would do the same thing but for changes in the FAIR VALUE of something. Download our free guide to learn to get the most out of your retirement funds.

View CASH FLOW VS FAIR VALUE HEDGEdocx from FIN 2 at Blue Mountains Hotel School. The key difference between the two types of hedges is the hedged item. What is a cash flow hedge and how is it different from a fair value hedge.

Ad An Evolved System For Alternative Investing. Learn What EY Can Do For Your Corporate Finance Strategy. With a cash flow hedge youre hedging the changes in cash inflow and outflow from assets and liabilities whereas fair value hedges help to mitigate your exposure to changes in the value of.

Cash flow fixed rate debt is not a cash Fair Value. Terms in this set 12. Hedge accounting attempts to reduce the.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. To mitigate this risk you could buy some copper futures contracts which would increase in value if the price of copper were to rise. The cash flow hedge is done to mitigate the risk associated with increases or decreases in foreign exchange rates changes in interest rates changes in asset prices etc.

Fair value hedges are instruments to protect one from changes in value of. Download our free guide to learn to get the most out of your retirement funds. Fair Value hedge is to hedge an asset you have currently like inventory etc where youre trying to protect the value in case the FV drops on.

This is your one stop shop. -acquired to hedge against a recognized asset or liability or a firm purchase commitment. Ad Financial Planning is complicated let us simplify it for you.

CASH FLOW VS FAIR VALUE HEDGE. -gain or loss in income from continuing operations IS Should be. A cash flow hedge is a hedge of the exposure to variability in.

Fair value hedge summary. Change in the mark to market of the hedge to flow through to the income statement offsetting the impact of the spot change in value of the underlying asset or liability. On the other hand a fair.

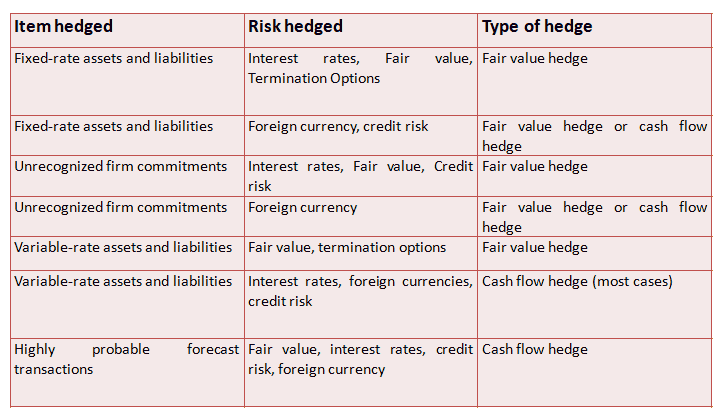

Cash flow hedging by. Hedge accounting is a method of accounting where entries for the ownership of a security and the opposing hedge are treated as one. Type of Hedge Fair value hedge except for a hedge of the foreign currency risk of a firm commitment which may be accounted for as a fair value hedge or a cash flow hedge Cash.

Cash flow hedges are instruments to protect one from changes in value related to future cash flows. Ad EY Corporate Finance Consultants Help All Types of Businesses with Key Financial Issues. Ad List of 55 hedge funds in Australia Download now.

For example if your company. On the other hand a fair value hedge is a type of hedging instrument designed to limit exposure to changes in the value of an asset or liability. Ad Financial Planning is complicated let us simplify it for you.

There are several types of hedges but for todays discussion we will use only two cash flow hedging and fair value hedging. When hedging the changes in cash flow from assets and liabilities you are using what is called a cash flow.

Derivatives Hedge Accounting Flashcards Quizlet

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Net Investment Hedge Annual Reporting

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

On The Radar Hedge Accounting Dart Deloitte Accounting Research Tool

Comments

Post a Comment